The Reflex credit card is another great option for anyone looking to improve their credit score. If you plan on using a credit card from them, it’s even better to have an online account for your credit card. With the online account, you get a quick turnaround and a simple application process for any product.

or

Reflex Credit Card Continental Finance is one of the largest distributors and issuers of credit cards in the United States. They are for those with bad credit and have an A+ rating from the Better Business Bureau.

The Reflex Credit Card App helps its customers to build or establish credit in a dignified and respectful manner. If you have less than full credit, a CFC-branded card can help you rebuild your credit history.

How To Register For The First Time?

If you decide to apply for this credit card, you must follow a simple online application process. Unlike some of these credit cards for low credit customers (which cannot be applied for until you receive an inviting offer), this card is free. Here we explain step by step how to apply for the Reflex Mastercard Login.

- First, you need to open the website at www.reflexcardinfo.com.

- On this site, you need to click the “Apply Now” button on Reflex Mastercard Login. If you have an offer in the email, click this button.

- Immediately after that, you can see the pre-qualification form; You must complete it to see if you qualify for this card.

- At this point, you must provide the following Reflex Card Info: your full name, address, email address, telephone number, social security number, date of birth, and monthly income.

- Then answer the following questions by selecting “Yes” or “No”.

At the bottom of this page, you need to check the boxes next to “I confirm…” and “I understand” and click on the “View my card offers” button. After that, you’ll be able to see all the credit cards you currently (and potentially) qualify for.

You can now access your account at www.reflexcardinfo.com to make a Reflex MasterCard payment online, view bank statements, check your balance, and modify your account details after you register your Reflex Credit Card App online business. Account Reflex Card Info, adding another user, and changing your credit limit.

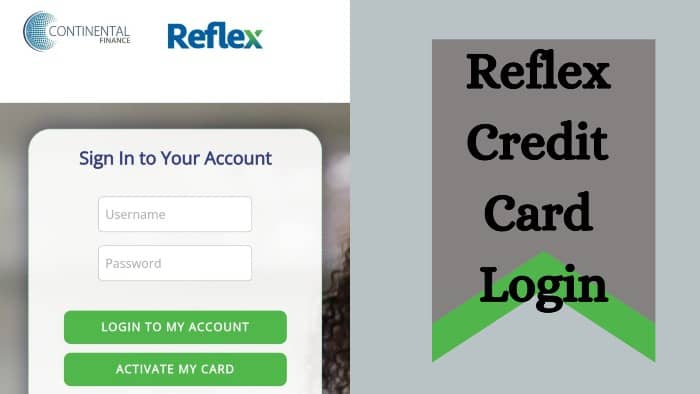

Login Process For Registered Users

There are a couple of options that you can choose from when managing your credit card online. The only downside to this is that you are required to login into your Reflex Credit Card Account every time you want to use the card. We will be able to show you step by step on this part of our website at www.reflexcardinfo.com how to login to your Reflex Credit Card.

- First of all, you need to access the portal of this credit card by clicking on the official website www.reflexcardinfo.com.

- At the top of this page, you need to click on the green “Reflex Credit Card Login” button.

- Immediately after you will see the Reflex Credit Card Login form for the Reflex credit card – here you can access your card account online.

- You must first enter your username in the first field of this form.

- Then enter your password in the text field.

- When finished, you can complete the registration process by clicking the submit button.

- If you entered everything correctly, you will be redirected to your account within seconds.

List Of The Reflex Credit Card Login Features

- See if you’re pre-qualified without affecting your credit score

- All types of credit can be requested

- The credit limit of up to $1,000 is doubled to $2,000! (Just pay your first 6 minimum monthly installments on time)

- Free access to your Experian Vantage 3.0 score (when you sign up for eStatements)

- Monthly reports to the three major credit bureaus

- Fast and easy application process; results in seconds

- Use your card anywhere Mastercard is accepted

- Current account required

- Mastercard Zero Fraud Liability Protection (subject to Mastercard policies)

- Make sure you qualify without affecting your credit score

- The credit limit of up to $1,000 is doubled to $2,000! (Just pay your first 6 minimum monthly installments on time)

- Free access to your Experian Vantage 3.0 score (when you sign up for eStatements)

- All types of credit can be requested

- Card offers are valid for a genuine Mastercard with a credit limit between $300 and $1,000 (depending on available credit).

- Mastercard Zero Liability Protection (Subject to Mastercard Policies)

- Use your card anywhere Mastercard is accepted

- Monthly reports to the three major credit bureaus

- 24.99% – 29.99% APR (varies)

- $75 – $99 annual fee

| Official Name | Reflex Credit Card |

|---|---|

| Portal Type | Login Portal |

| Services | Credit Card Services |

| Managed By | Continental Finance |

| Country | USA |

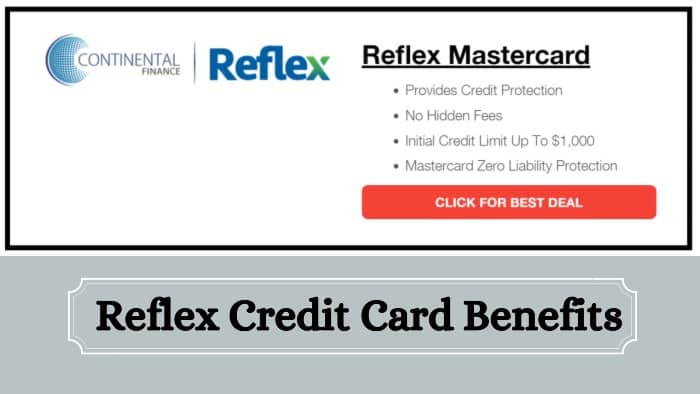

Enjoy The Portal Benefits

There are several Reflex Credit Card Login benefits that one can get with the Reflex Credit Card App.

- In six months, you have the opportunity to double your credit limit if you pay your bill on time.

- You can use your MasterCard anywhere.

- Register with all three credit bureaus and it’s a great credit card to use to boost your credit score.

- You don’t have to pay hidden fees or deposits.

- You can check your monthly scores for free with Experian Credit Scores.

- Initial credit limits up to $1,000 and doubling up to $2,000

- Offers Mastercard zero liability protection.

- Monthly reports to the three major credit bureaus.

- A free monthly credit score is available on eStatements.

Different Payment Methods

Thinking about paying with a credit card

There are currently three common Reflex Card Payment methods for your My Reflex Card Login: online, by phone, and by mail. In this part of our article, we’ll show you how to pay your card in each of these ways.

First, you can pay for your Reflex MasterCard Online; This is the most convenient way to do it. To do this, you must follow our instructions in the “Login” section and log in to your card account online. You can then select “Make Payment” and pay your credit card from there.

Second, you can pay with your credit card Over The Phone. To do this, you must call 1-800-518-6142 and ask the carrier to pay your credit card. Then just follow the instructions. However, please note that a fee may apply for this service.

Finally, you can choose to Mail Your Payment. If you decide to do so, you can use the following address:

Reflex map

Field 6812

Carol Stream, IL 60197-6812.

About Continental Finance

As a leading US credit card processor and provider of credit card services to consumers with less-than-perfect credit, Continental Finance is one of the leading names in the industry. The right product will be available to you regardless of whether you have fair credit, a bad credit record, or limited credit. In 2005, Continental Finance Company (CFC) was founded to meet the needs of consumers with financial insecurity through credit card lending and financial services.

If you have any questions or need assistance, you can contact Continental Finance Reflex Credit Card Customer Support at 1-866-449-4514. The company manages a number of credit cards on behalf of its clients. For that reason, if you have a specific question, you can find the contact details for each card by clicking here, which will give you their details.

TheReflex Card Login is an expensive entry-level credit card for those with limited or no credit history, as well as those with bad credit looking to start over. It belongs to the Mastercard credit card network but is issued by Celtic Bank and managed by Continental Finance Company.

Common Questions

What is Reflex MasterCard?

Therefore, this credit card was developed by Continental Finance to help customers with very bad credit get an unsecured credit card. However, it is debatable whether the card’s exorbitant fees would prevent customers from recovering their credit history.

What are the ReflexCard card fees?

In terms of annual fees, you will be charged $99 per year. Obviously, this is one of the highest annual fees in the entire market.

Which bank issues the Reflex MasterCard?

Celtic Bank currently issues several credit cards to Continental Finance, including this My Reflex Card.

What is the minimum credit score for a Reflex credit card?

As the ad suggests, customers with any credit score can apply. Therefore, it is possible that you will be approved for this credit card with no credit history (or extremely low credit history).

How do I receive money with a Reflex credit card?

In principle, you can withdraw cash at any ATM that accepts MasterCard cards. However, we strongly advise against taking out cash advances as the interest rates and fees are very high.

How do I cancel my Reflex credit card?

To close your Reflex Mastercard Login, call 1-866-449-4514.

How do I pay with a My Reflex Card Login over the phone?

Just look for the customer service phone number on the back of your card. Call this number and listen for prompts to pay over the phone.

Reflex Credit Card Customer Service Information

Automated Account Information

1-866-449-4514

(Available 24/7)

1-866-449-4514

(Reflex Credit Card Customer Service Specialists are available Monday-Friday 7 am-10 pm and Saturday/EST 9 am-4 pm)

Reflex Card Payment

1-800-518-6142

(7:00am to 10:00pm Monday to Friday, 8:00am to 4:00pm Saturday/EST)

1-800-556-5678

Request Reflex Card Login

DUST. Field 3220

Buffalo, NY 14240-3220

Payments On Account

Reflex map

DUST. Field 6812

Carol Current, IL 60197-6812

Conclusion

The article on the Reflex credit card did a good job of introducing you to the card. The purpose of this article is to provide a guide on how to verify, apply for and register your Reflex MasterCard card. The reviews did not stop there, because we also looked at the pros and cons of using this card. Finally, as an added bonus we also offer the option to pay with a Reflex MasterCard or a Reflex Card.